Labor has said all options are on the table to address Australia’s structural deficit and falling tax revenues, following disclosure this week of a $12 billion revenue shortfall, just weeks from the federal budget.

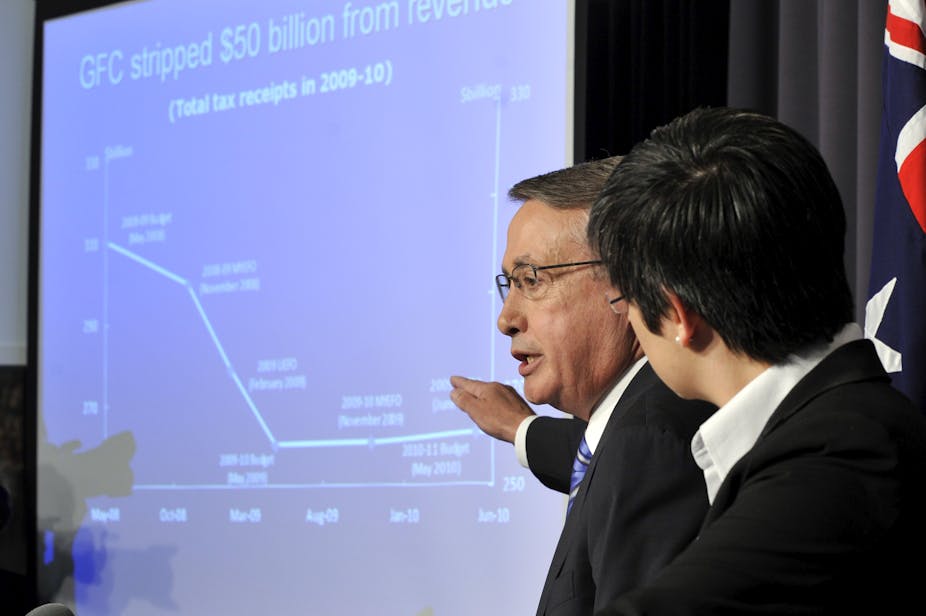

Political debate has centred around whether this has been a revenue problem - as argued by Treasurer Wayne Swan - or a spending problem, as claimed by Tony Abbott - and which government was responsible: Howard and Costello, or Rudd and Gillard.

Irrespective of all of this, it is important to steer the economy back to balanced budgets. Why?

Unless this spending path is broken, Australia could risk an unpleasant speculative attack on its currency at some point in the future. And it risks having little to fall back on if economic conditions substantially worsen.

Australia’s budget has been in deficit since the onset of the global financial crisis in 2008. No serious corrective course of action has been taken to reduce it - even though deficits are usually run in recessions, not during an unprecedented mining boom.

Simply, it would have been much better if the government had saved up for a rainy day so that it would have the means available to stimulate the economy in times of economic weakness without being forced down the austerity path when it is the least desirable.

Regardless of prevailing economic conditions, future government budgets will be facing additional challenges posed by the retiring Baby Boomer generation, which will place additional burdens on public expenditure with increasing pension outlays and health care commitments over the next decades. On the revenue side, the picture is not looking too good either.

Income-related taxes, the main source of government revenue, are not likely to grow at the pace we have seen over the past two decades, as the growth effects from the booms in mining and university graduates level out.

Furthermore, revenues from stamp duties on housing purchases, which are an important source of income for state governments, are likely to remain low in the future, as the trend in housing prices and turnover in the housing market points downward. This will have knock-on effects for the federal budget as states may demand a greater share.

An argument for not reducing the government deficit is that a contractionary fiscal policy would reduce demand and create unemployment.

How credible is this thesis? According to simple textbook Keynesian analysis, a decrease in government spending of 10% reduces income by more than 10% because the initial spending cuts lead to subsequent private sector spending cuts and, therefore, to additional demand contraction. From this analysis, it follows that government spending is influential for GDP and that any fiscal tightening (reduction in government spending) would reinforce any economic downturn.

However, this simple analysis is misleading. First, private saving, to a large extent, counterbalances public savings. In other words, the private sector responds to public sector deficits by increasing their savings because they know that the government debt has to be paid back in the future and because government deficits are often associated with uncertainty and macroeconomic mismanagement.

Second, the interest rate on government debt can increase suddenly if the financial markets consider the government’s policy to be unsustainable. As we have seen in southern Europe, this can usher the economy into a downward spiral.

Take a hypothetical example. Suppose that the government debt-GDP ratio climbs to 50% and that the interest rate increases by six percentage points, due to an increase in the risk premium. That will automatically add three percentage points to the government deficit as a percentage of GDP.

Third, if the situation gets too grave, Australia could experience capital flight, an unpredictable event driven by sentiment, rumour and irrational exuberance in the financial markets.

Fourth, the GFC was an outcome of a massive increase in private debt exposure fuelled by easy access to credit at low cost and a booming housing market. Trying to keep the spending bubble up through deficit spending, although practised in the US, France and Japan, is an absurd policy. Australia’s private debt-GDP ratio needs to be reduced before the government should continue its deficit spending.

It can be argued Australia is on an sustainable government debt path. After all, Australia’s government debt is around 27% of GDP, a comparatively low figure relative to other rich countries.

However, this misses the fact that the private sector is already very indebted. The ratio of credit to the private sector and GDP is currently around 150%, well in excess of its sustainable level and this, in the worst case scenario, could lead to a capital flight with potentially dire consequences for the Australian economy.

Furthermore, my calculations indicate the government debt-GDP ratio is likely to increase to 50 to 100% over the next 10 years if the current deficit spending is maintained.

A further danger is that the debt-GDP ratio could suddenly increase if there were to be a severe economic downturn. In the period 2007-2012, Ireland’s debt-GDP ratio increased by 92 percentage points. In the same time, debt-GDP ratio jumped by 63% in Greece, 57% in Japan, 54% in the UK and 42% in the US.

It can be argued the economic circumstances prevailing in Australia make it unlikely that we would go down this route.

But the examples do show the situation can go downhill very quickly, particularly if the economy is on the wrong track.

Government policy needs to be mindful of these possible future pitfalls. It makes sense to rein in government spending to ensure there are reserves available to deal with any future negative shocks.