Articles on Money laundering

Displaying 1 - 20 of 69 articles

Food fraud costs billions globally. But blockchain and machine learning offer hope for a more transparent and safer food system.

A well governed financial system is effectively supervised by the central bank.

Kenya must complete a national terrorist financing risk assessment and share it publicly.

The downfall of the onetime multibillionaire holds lessons for investors and regulators alike.

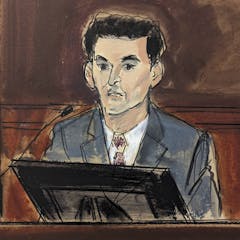

Cryptocurrency tycoon Sam Bankman-Fried may face a jail term of more than a century after conviction on seven counts of fraud and money laundering.

Higher education institutions are not explicitly included within the UK’s anti-money laundering regulations.

Numerous terrorist attacks in the UK and abroad have been financed by fraud and the government needs to close financial loopholes to prevent future tragedies.

Banks in the UK have to conduct extra checks on people more at risk of blackmail – and an easier option is sometimes just to say no to giving them and account.

For 16 years, the government has failed to reform our anti-money laundering and counter-terrorism financing laws to include professionals like real estate agents and lawyers.

In a world where economic sanctions make trade in US dollars almost impossible, gold has offered a way to evade these restrictions.

The Economic Crime Bill is supposed to be riding to the rescue, but it won’t make much difference in its current form.

In being grey listed South Africa joins a list of countries with poor governance. Others are war zones or countries with jihadist terror groupings operating on their land.

Raymond W. Baker says the estimated hundreds of billions of dollars in hidden wealth a decade ago has skyrocketed to trillions today.

NSW Premier Dominic Perrottet has convinced his cabinet to back major pokie reforms, and they will be a vast improvement on the current situation.

South Africans are actively challenging the criminalisation of the state. Many of the revelations about fraud, corruption and nepotism come from principled whistle-blowers within the state.

The new book is structured around apartheid profiteers, war profiteers, state capture profiteers, welfare profiteers, failing auditors, conspiring consultants and bad lawyers.

The impeachment process could derail Ramaphosa’s political career and seriously hurt the governing ANC’s electoral prospects in 2024.

South Africa has long been seen as deficient in dealing with terrorism financing.

While the overwhelming majority of charities are legitimate, looking into a charity before supporting it can help you avoid supporting scams and make better-informed decisions.

Australian governments appear to implicitly accept that illegality comes with the territory of legal casinos.