Articles on Financial regulations

Displaying 1 - 20 of 106 articles

A recent corruption case in Vietnam has led to the owner of a bank being sentenced to death.

There are some fundamental differences between listing on the LSE and in the US – and they may be contributing to London’s decline.

The general public may want tighter crypto regulations but is the UK government listening?

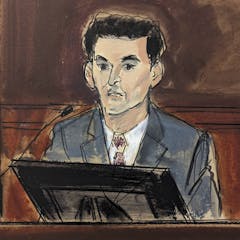

Cryptocurrency tycoon Sam Bankman-Fried may face a jail term of more than a century after conviction on seven counts of fraud and money laundering.

More diversity in the banking sector can help with stability, but Revolut’s two-year wait for a UK banking licence indicates regulatory caution.

Are buy now, pay later services truly a new way to boost financial inclusion, or just another type of predatory loan?

Our study shows the way bank bosses talk about risk can negatively affect financial stability.

Crypto platforms are calling for clear regulations rather than lawsuits from regulators.

The UK could learn a lot from developing economies about using digital payments to boost financial inclusion.

US regulators are beginning bringing more enforcement actions against crypto firms, with the latest targeting top exchange Binance.

Central banks are reaching into their toolkits to shore up the global financial system.

The failure of Silicon Valley Bank has exposed gaps in financial regulation that could be tricky to fill.

There are two types of systemic risk that can infect the highly interconnected global banking system.

Companies benefit from certain internal environmental and social checks and balances, particularly when it comes to preventing a tumble in their share price.

Small companies should think hard about their finances and how to make them more secure, particular in uncertain times.

New rules following a spate of bank failures in 19th century Britain could provide some lessons for today’s regulators.

The speed of SVB’s collapse was a surprise but central bankers can learn lessons from this failure.

New green finance measures aside, UK chancellor Jeremy Hunt’s Edinburgh reforms look like history repeating itself.

Even though some traditional financial firms parked millions in the bankrupt company – once valued at $30 billion – the impact of FTX’s spectacular crash is limited to crypto investors

New research suggests financial regulators will never win.